Why Just About Every Marketer Stays Broke (Even After Making Money)

Building a business online can be exciting, overwhelming, and intimidating all at once.

While it’s true that the initial costs for an online business are much lower than opening a brick-and-mortar store, the expenses can still add up fast if you’re not paying attention.

If you’ve already made a few bucks online – maybe sold a product, picked up a client, or landed an affiliate commission… congrats! That’s a solid start.

The Stripe alerts and PayPal notifications on your phone are rolling in, and it feels like things are finally happening.

But oddly, your wallet may still feel suspiciously light.

If you’re wondering where your money went, you’re not alone.

A lot of marketers are very adept at generating an income. But few know how to keep it, manage it, and grow it like a real business.

And that’s why they need to read this article.

In fact, this is not just an article – it’s a field manual for anyone building an online business who wants their bank account to actually reflect their hustle.

This is how you manage your money while building a thriving online business…

Step 1: Know Your Business Stage

Your financial plan should match where your business actually is, not where you wish it was.

If you’re just getting started, it’s essential to operate lean.

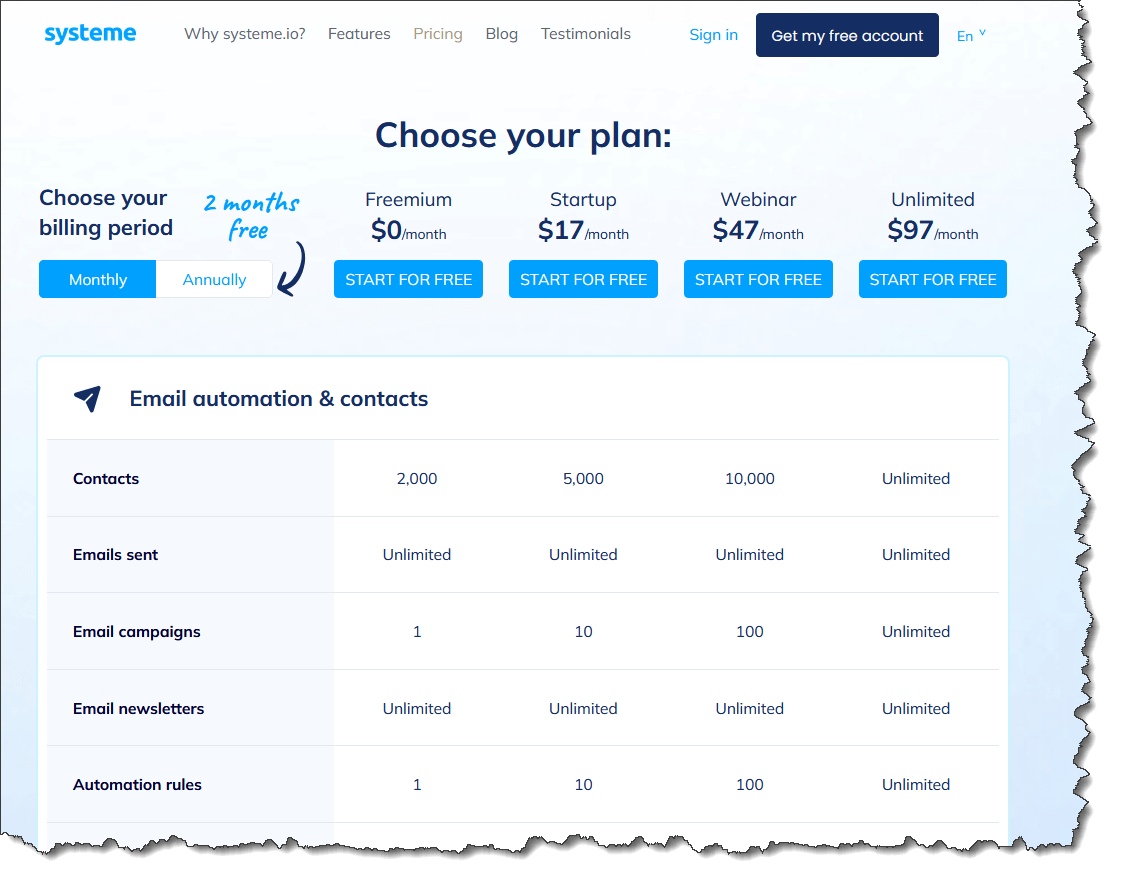

That means using free tools such as Systeme.io. etc.

You want to keep costs minimal, and focus on learning what works without blowing your savings on high-end software or paid communities you’ll never engage in.

If you’re somewhere in the middle, maybe with a few consistent income streams, your biggest challenge is probably unpredictability.

One month you make $3,000, the next you’re scraping together invoices. At this ‘feast and famine’ stage, it’s all about tracking, controlling costs, and building a buffer.

If you’re further along with regular income and a growing list of tools and team members, your focus shifts to efficiency.

Different stages require different money moves. Know your lane and plan accordingly.

Here are the stages…

. Beginner

You’ve made a few sales. You’ve bought too many courses. You’re trying everything at once.

Money rule: Spend as little as possible. Stick to free tools. Focus on validating offers quickly.

. Intermediate

You’ve got some consistency. Clients or sales are coming in, but your expenses are still out of control.

Money rule: Start budgeting. Audit your spending. Build a buffer.

. Pro

Revenue is solid. Maybe you’ve got a small team. But you’re still not seeing the profit you expected.

Money rule: Track everything. Delegate strategically. Cut waste.

Know where you stand. Spending like a “7-figure business” before you’re even profitable is just a fast way to go broke with a prettier dashboard.

Step 2: Budget Before You Need To

Most people treat budgeting like a fire extinguisher – only useful once the flames are already raging.

You, however, need to think ahead. If you’re budgeting after the money runs out, you’re already too late.

Start by listing every income stream: freelancing, product sales, affiliate payouts, and even small side gigs.

Then write down your monthly expenses.

Break them into two categories:

- Fixed

- Variable

Fixed costs are things like email platforms, domain renewals, hosting. Variable costs include ad spend, courses, and freelancers.

Then list every single expense, including the small ones. A $12 subscription you forgot about for six months? That’s $72 down the drain.

If you’re consistently overspending, the first fix is awareness. Once you see everything in one place, you’ll start making better choices. Awareness leads to control. Control leads to actual progress.

Know where the leaks are before they become floods.

Use a Notion template, Google Sheet, or simple app to track the money. Use whatever works for you.

Step 3: Build an Emergency Fund

When Stripe freezes your account, or a client ghosts on an invoice, you’ll wish you had a buffer.

Start by aiming for $1,000. That alone can help cover a slow month or an unexpected bill. Eventually, stack up enough to cover 3-6 months of core expenses.

Keep it separate. Preferably in another bank account. The harder it is to “accidentally dip into,” the better.

An emergency fund won’t make you rich, but it will keep you in the game when things get shaky. You’ll also avoid the stress and paranoia of wondering how to make rent next month

Step 4: Spend When You’re Building, Not Just Planning

This is a very common mistake that newbie (and even intermediate) marketers make.

They spend on domains, tools and software for future projects they haven’t started on yet. Buying tools for future projects is a sneaky way to kill momentum and drain your budget.

Before you buy anything, ask yourself three things:

- Are you working on a project right now that requires this?

- Will this help you earn or save money in the next 30 to 60 days?

- Will this tool help me lower costs?

If the answer to all three is no, cancel it or find a cheaper option.

Step 5: Kill Shiny Object Syndrome

Every marketer has done it. You see a flashy new course, a limited-time SAAS deal, or a guru promising the secret to passive income… and you whip out your wallet.

Suddenly, you’ve spent $297 on something you’ll never use.

The solution isn’t willpower. It’s systems.

You should create a “wishlist” instead of buying on impulse. Check it weekly. If you still want it a month later and you’ll actually use it, go for it.

The key to online success isn’t collecting tools – it’s implementing what you already have.

Always remember, you only make money when you sell… not when you buy unnecessary courses and tools.

Step 6: Cut Costs Without Stalling Your Business

It’s important to understand that running a lean business is all about focus and not about being a cheapskate.

By trimming the unnecessary costs, you’ll be increasing your bottom line.

If you’re a beginner who’s starting out, it’ll be more cost-effective to use an all-in-one platform like Systeme.io.

With one low, flat (monthly) fee, you’ll have access to most of the tools you’ll need to run an online business.

Use free or freemium versions of tools until you’ve outgrown them:

- Marketing tools: Systeme.io

- Design: Canva

- Docs: Google Drive

- Organization: Notion

- Payments: Stripe/PayPal

Cutting unnecessary subscriptions saves you hundreds per year – money which you can actually reinvest in your business (or save in your ‘emergency fund’).

Step 7: Split Your Money Intentionally

It’s easy to treat business income like a jackpot. One good month, and suddenly you’re spending like it’s Q4 every day.

Instead of going haywire when you get a business windfall, a wiser option will be to give every dollar a purpose.

Here’s a simple method to manage your income:

- 50% – Reinvest into the business (ads, tools, services, courses)

- 30% – Save (or build your emergency fund)

- 20% – Pay yourself

This system keeps you grounded and gives your business room to grow without suffocating your personal finances.

If your income fluctuates, base the split on your average monthly revenue from the last three months. This helps keep spending realistic.

Step 8: Don’t Quit Your Job Too Early

It’s tempting to go full-time as soon as you have one great month.

But one spike isn’t a trend. Going all in without a safety net turns your business into a source of stress instead of freedom.

You’re ready to go full-time when:

- Your business consistently brings in 2x your monthly personal expenses

- You have 3-6 months of expenses saved

- You’ve got systems that produce predictable income

You should be earning online what you’re earning at your day job (or more).

Like the late motivation speaker, Jim Rohn, used to say, “I’m working full time on my job and part time on my fortune.”

After 6 months of steady income, you’ll be ready to tell your boss to… well, you know what to do.

Until then, use your day job as startup capital. Let it fund your business until your business can fund your life.

Step 9: Build Habits That Actually Stick

Managing your money is more about rhythm than perfection.

Check in weekly. Review expenses. Look at income. Adjust as needed.

Each month, run a quick report:

- What did I make?

- What did I spend?

- What’s worth repeating?

- What needs to be changed?

Set goals based on your numbers. Not vanity metrics. Not likes. Real goals like increasing profit margin or cutting tool costs by 20%.

Good habits beat good intentions. Every time.

In conclusion…

Steer clear of the common mistakes that marketers make when it comes to money. It’s imperative to understand that revenue is flash, but profit is real freedom.

Also, it doesn’t matter how much you make. What matters is how much you keep.

If your business generates $10K in profit a month, but your expenses and costs total $8K, then what you have is a $2K business.

It’s tempting to chase revenue out of vanity. But if there’s nothing left over at the end of the month, what are you really building?

Profit lets you breathe and grow. It gives you leverage, security, and options.

So, track your money and spend only when it makes sense. Build margin and resilience.

The smartest marketers aren’t the ones with the flashiest tools.

They’re the ones who build something that lasts… and can actually keep the money they make.

That’s real winning.